HOW TO TRANSFER SHARES IN PRIVATE COMPANY?

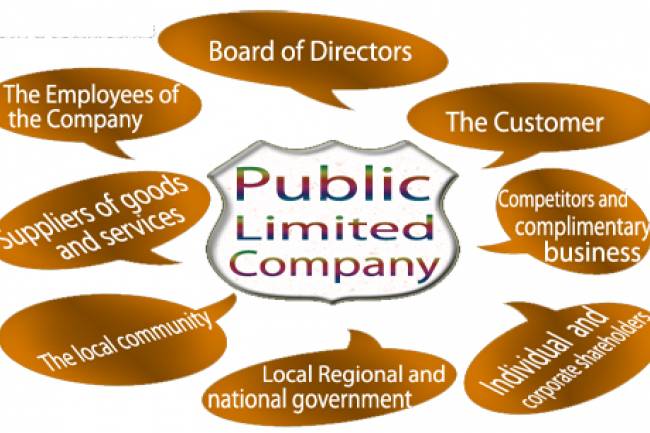

Before we can discuss the essential theme of Transfer of Shares in a Private Company, we have to comprehend the two key terms included – "Privately owned business" and "Offers or Share Capital".

What is a Private Company?

Private Limited Companies are those sorts of organizations in which the quantity of individuals run from two to two hundred. A private constrained organization has the restricted risk of individuals, which stretches out to the offer capital they hold in the organization. As indicated by the Companies Act of 2013, a privately owned business can't welcome the general population to subscribe to any securities of the organization. Additionally, a privately owned business appreciates an extraordinary right of limiting the transferability of offers, which empowers them to look after possession. Segment 2(58) (I) of the Companies Act, 2013 gives that the Articles of privately owned business might confine the privilege to exchange the organization's offers. Nonetheless, the confinement on move of offers in a privately owned business isn't pertinent in specific cases, for example, on the privilege of an individual from the organization to exchange his offer to his legitimate delegate and in occasion of death of an investor, the exchange of offer to his lawful beneficiary can't be limited. It is additionally to be noticed that the limitation can't be made as forbiddance however just by the Articles of Association (AoA or By-Laws) of the organization.

What is Share Capital?

The offer capital in a private restricted organization is the measure of cash put by its proprietors in return for offers of possession. Organization chiefs are regularly investors in their own organizations. Investors practice certain controls over how the organization is run, for example, choosing the governing body.

Fundamental Provisions identified with Transfer of Share:

Since we have perused about the two key terms, we are to inspect the legitimate point of transferability of offers in a privately owned business. The exchange of offer capital in a private or open organization are to be done as per the arrangements of Companies Act of 2013. The significant arrangements identified with the transferability of offers are recorded beneath:

Instrument for Transfer of Share is obligatory:

As per Section 56 of the organizations demonstration, an organization should not enlist an exchange of offers unless a bona fide move deed in Form SH.4 according to the Rule 11 of Companies (Share Capital and Debentures) Rules 2014 is appropriately stamped and executed by transferor or his specialist and by transferee or his operator, obviously indicating the name, address and occupation(if any) of the transferee, alongside the testament identifying with the offers (or if no such endorsement is in presence, alongside the letter of allocation of the offers).

Day and age for store of Instrument for Transfer:

Frame SH. 4 or the instrument for exchange of offers, with date of execution as said immediately should be in all conditions conveyed to the organization inside sixty days from the date of previously mentioned execution by the transferor and the transferee or by their individual operators.

Estimation of offer exchange stamps to be fastened on the exchange deed:

According to the notice dated 28th January 2004, by the Ministry of Finance (Department of Revenue), the stamp obligation for exchange of offers is settled to 25 paise for each hundred rupees.

Time restrain for issue of endorsement on exchange:

As indicated by Section 56(4), Every organization is required to convey the endorsements of all offers exchanged inside one month (30 days) of use for the enlistment of exchange of the any such offers.

Time Limit for Refusal of enlistment of Transfer:

Segment – 58 of the Companies Act manages the Refusal of Registration for the exchange of offers by the organization and furthermore with the interest against such refusal. As indicated by the area. The organization has the energy of refusal of enrollment for exchange of offers however it ought to be practiced inside thirty days of conveyance of the instrument of exchange to the organization.

Time Limit for claim against refusal to enroll Transfer by Private Company:

As indicated by Section – 58 (3) of the Act, a transferee of offers may speak to the Tribunal about such refusal inside the time of thirty days from the receipt of notice of refusal of exchange of offers by the organization. In the event that, there is no such notice issued by the organization, the transferee may offer inside sixty days of conveyance of the instrument of exchange or the suggestion of exchange, by and large, to the organization.

Punishment for Non-consistence:

According to the arrangements of the Act, where there is a resistance by the organization of the arrangements identifying with the exchange of offers, the organization might be culpable with the fine not less that Twenty-Five Thousand Rupees but rather which may reach out to Five Lac Rupees and each officer in default will be culpable with a fine at least Ten Thousand Rupees yet which may stretch out to One Lac Rupees.

Before going to the means including the move of offers in a privately owned business, we have to talk about a couple of focuses vital to be dealt with before starting any such exchange. Above all else, there must be a survey of Articles of Association (AoA) or By-Laws of the organization, if there is any limitation with respect to the exchange of the offers, it must be appropriately tended to before following up to the further advances. Once the move is in accordance with the Articles of Association, the investor must present a notice to the Director of the organization, expressing his goal about such exchange. The subsequent stage includes the assurance of costs of offers as per the Articles of Association, the standard practice in this course is the Director or the Auditor of the organization decides the cost of offers. The last advance before the start of exchange of offers is that the concerned organization should give a notice to the investor about accessibility of the offer, last date of procurement and furthermore the cost all things considered offers to be exchanged. It is to be noted that if any present investor approaches for the buy of offer, such offers should be distributed to them by the organization. On the off chance that, there are no present investors approaching, such offers will be then distributed to the untouchables.

The Process of Initiation of Transfer of Shares can be effortlessly comprehended by the accompanying Points –

Survey AoA – Review the AoA of private constrained organization and comprehend confinements, assuming any.

Pull out – Give notice to the executive of the organization about aim to exchange shares.

Decide Pricing – Company will then decide the cost of offers to be exchanged. Generally done by the executive and reviewer of the organization.

Exchange Shares – Transfer the offers to either the investors or a pariah, as the circumstance might be.

Method for Transfer of Share in a Private Company:

Stage 1:

The initial step is to get the offer move deed in an arrangement as recommended by the arrangements of Companies Act of 2013. For the specimen of such exchange deed.

Stage 2:

Once the offer deed is acquired in endorsed arrange, it is to be appropriately executed by the transferor and transferee or their specialists, by and large. In case of death of transferor or the transferee, their lawful agents may appropriately sign the deed.

Stage 3:

The properly marked and executed offer deed should bear stamps according to the arrangements of Indian Stamp Act and furthermore the stamp obligation notice in compel in the concerned state where the deed is being executed. The present rate of stamp obligation is 25 paise for each hundred rupees of the estimation of offers or the piece of such offers. It is to be precisely noticed that the stamps attached should be crossed out at the time or before marking of the exchange deed.

Stage 4:

The marking of exchange deed by the transferor and transferee or their operators is to be seen by a man, who should give his mark, name and full changeless address on the said deed.

Stage 5:

The following stage includes appending the applicable offer authentication or apportioning letter with the offer move deed in the recommended arrange and convey the same to the organization. P.S. the offer exchange deed must be conveyed to the organization inside sixty (60) days from the date of execution of offer deed by or for the benefit of the transferor and by or for the benefit of the transferee.

Stage 6:

Once the offer exchange deed is conveyed to the organization, the governing body should consider the same. In the event that the documentation for exchange of offer are observed to be all together, the board should enlist the exchange by passing a determination. This progression sets out finishing of move of offers in a private restricted organization.

Be that as it may, if the leading body of executive feels that the documentations are not in or arrange, or the means previously mentioned are not conformed to, the board holds the privilege of refusal of exchange of such offers to the transferee. Be that as it may, such refusal by the directorate must be suggested to the transferee inside thirty days of receipt of such exchange deed by the organization. Additionally, If the transferee feels that such refusal is discretionary and irrational, an interest lies with the Tribunal inside thirty days of receipt of notice by the organization of such refusal for the exchange of offers or in the event that there is no notice served by organization, the interest lies in the tribunal inside sixty days of conveyance of such offer exchange deed to the organization.

The Procedure for Transfer of Share in Private Company can be very much clarified by the accompanying focuses :

Acquire the Share Transfer Deed as Prescribed

Properly Executed by the Transferor and Transferee or their operators

Should bear stamps according to the arrangements of Indian Stamps Act and Stamp Duty Notification

Observer to sign the deed with name and perpetual address

Connecting the offer endorsement with the offer exchange deed and conveying it to the organization.

In the event that every one of the reports are observed to be in endorsed arrange, the leading group of executive might enlist the exchange by passing a determination.

Be that as it may, on refusal of such exchange of s

Visit HireCA.com Now