FAST TRACK BUSINESS MERGER

For The Small Companies and Holding / Subsidiaries, Who Wanted To Merge For The Small Companies and Holding

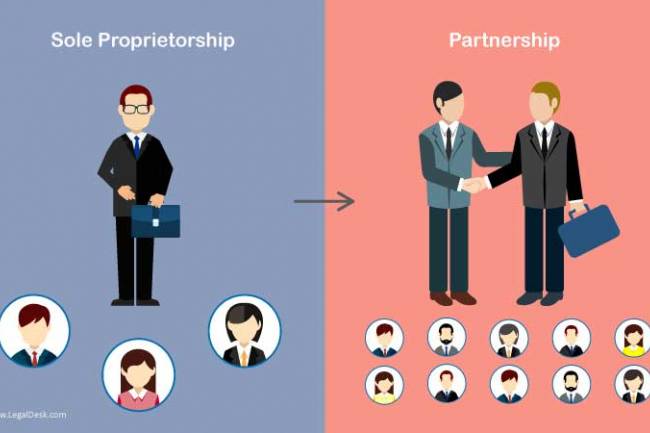

Merger means combining of two or more companies into one company, which results in merger of all the assets, liabilities of the companies under one business. The dissolution of company/companies involved in a merger happens without winding up.

Earlier whenever we hear the word Merger, it means the High Court Approval and the High Court approval in its own was a big thing.

In the erstwhile Companies Act 1956, application for merger between two or more small companies and for merger between wholly owned subsidiary companies and Holding Company was filed with respective High Court(s) and they will have to wait in long queue for merger approval which generally takes 6-8 months.

But in the Companies Act 2013, Section 233 comes out with the concept of Fast Track Exit which is also an initiative of the Government for “Ease of Doing Business”. This section 233 gets notified and came in to effect on 15th December 2016.

This section 233 provides for Fast track merger in cases of merger between:

- Two or more small companies ( with less than Rs.50 Lakh paid up capital or less than Rs.2 Cr of Turnover) or

- Between a holding company and its wholly-owned subsidiary company or >

- Such other class or classes of companies as may be prescribed; ( No other class of companies have yet been prescribed by the Central Government)

Procedure

The memorandum of association of the companies seeking to merge, should give power to companies to amalgamate. If not provided in the Memorandum of Association then as a first step get the memorandum of Association Amended to insert the provision empowering the company to get itself merged with one or more other companies.

Convene the Board of Directors meeting to get the scheme approved in both the Transferor Company and the Transferee Company.

Send Notices in Form CAA.9 to the Registrar of Companies (ROC), Official liquidator’s office (OL) and such other persons who are all affected by the scheme of merger, inviting objections or suggestions on the scheme of Amalgamation by both the Transferor Company and the Transferee Company.

The Notice given to the shareholders or creditors or any class of them, shall be contain the Scheme of Amalgamation, statement disclosing the scheme of amalgamation and the effect of the scheme on its stake holders such as the shareholders, Bankers, creditors, employees, Govt., and to the general public etc.,, Copy of the valuation report, Certification from auditors saying accounting treatment is in consonance with accounting standards. Notice shall also be published on the website of the company.

If there is any objections then that has to be intimated to the Regional Director within 30 days from the date of the receipt of the Notice in Form CAA.9

File Declaration of Solvency by both the Transferor and the Transferee Company in Form CAA.10 with the Registrar of Companies. This has to be filed before convening the Share holders / Creditors meeting for getting approval of the Scheme.

Any objections or suggestions received from the ROC / OL then that has to be considered and appropriately modified to accommodate such objections / suggestions.

Objections can be raised by the shareholders who is holding more than 10% of the voting rights and a creditor who is holding 5% of the net outstanding payables by the company.

Shareholders Approval has to be obtained in a duly convened meeting from shareholders with 90% of the shareholders approving the resolution.

Creditor’s Approval: By Meeting: Such Scheme shall also be approved by the majority representing 9/10th in value of creditors or class of creditors of the respective companies indicated in a meeting convened by the company by giving a notice of 21 clear days; or

Without Meeting: Such Scheme shall also be approved in writing by the majority representing 9/10th in value of creditors or class of creditors of the respective companies.

In such a case, no Meeting of Creditor will be required.

Companies have to give a newspaper advertisement announcing the Notice; it shall indicate the time within which copies of the scheme shall be made available to the concerned persons. The copies of notice shall be made available to the concerned person free of charge from the Registered Office.

Filing of Approved Scheme:

The transferee company shall file a copy of the approved scheme along with the result of each meeting of Shareholders’ Meeting or the Creditors’ Meeting, in form CCA-11 with the concerned Regional Director, within 7 days from the date of the meeting.

Such scheme shall also be file along with form CAA-11 in form GNL-1 with Registrar of Companies and Official Liquidator through hand delivery or by registered post or speed post.

Approval of Scheme

Registrar of Companies and Official Liquidator may give objections or suggestions, if any, to the Central Government (Regional Director) within 30 days. However, where no objections or suggestions have been made, it shall be presumed that they has no objection to the Scheme.

Where Registrar of Companies and Official Liquidator have not given any objections or suggestions or the objections or suggestions have been given deemed to be not sustainable and Central Government (Regional Director) is of opinion that the scheme is in public interest or in interest of creditors, Regional Director shall confirm the scheme in Form No. CAA-12.

On the basis of objections or suggestions made by the Registrar of Companies and Official Liquidator or otherwise, Central Government (Regional Director) is of opinion that the scheme is not in public interest, it may file an application before the Tribunal in Form No. CAA-13 within 60 days of the receipt of the scheme stating its objections or opinion and requesting that Tribunal may consider the scheme under section 232 of the Act.

Filing of Order:

The order approving the scheme shall be filed inform form INC-28 with the Registrar of Companies within 30 days having jurisdiction over the transferee and transferor company

Effect of the Scheme:

The assets and liabilities of the Transferor company will be transferred to the acquiring company in accordance with the approved scheme, with effect from the specified date. As per the proposal, the acquiring company will exchange shares and debentures and/or cash for the shares and debentures of the acquired company. The transferor company will get dissolved without process of winding up. The Charges on the property of the transferor company shall be applicable and enforceable as if the charges were on the property of the transferee company. The legal proceedings by or against the transferor company pending before any court of law shall be continued by or against the transferee company.

On merger, the share capital held by the transferee company in the transferor company would have to be cancelled and cannot be allotted to any trust either on its behalf or on behalf of any of its subsidiary or associate company.

Post Merger:

The transferee company shall file an application with the Registrar along with the approved scheme, indicating revised authorized capital. The transferee company is not required to pay fee on the revised authorized capital to extent of the fee paid by the transferor company before the merger and amalgamation.

Visit HireCA.com Now